“What’s your star sign?”

This is the first question Anthony Scaramucci — financier, media-savvy operator, and former White House communications director — asks me as we sit down for breakfast at a quiet New York City social club. Over a cappuccino with almond milk, Scaramucci reveals a quirky fascination with astrology that began 38 years ago, when he learned that First Lady Nancy Reagan consulted an astrologer to set President Ronald Reagan’s schedule.

Scaramucci, 61, is a Capricorn, and he believes Capricorns are destined for a dramatic rise, a monumental fall, and, if they’re lucky, a climb back to the top. He points to Richard Nixon’s Watergate disgrace, Woodrow Wilson’s debilitating stroke, and MLB pitcher Ralph Branca’s infamous home-run pitch as evidence.

“Capricorns have one major blow-up,” he says. Scaramucci has had three: the near-collapse of his investment firm SkyBridge Capital during the 2008 financial crisis, his infamously short-lived stint in the (first) Donald Trump White House, and, most recently, his ill-fated partnership with Sam Bankman-Fried, whose cryptocurrency exchange FTX purchased a 30% stake in SkyBridge before descending into scandal and bankruptcy.

But Scaramucci has never been one to accept defeat. His latest act might be his boldest yet: doubling down on a high-stakes crypto bet that looks to be paying off. If he succeeds, he could cement his status as a financial visionary who saw the potential of digital assets before others. If he fails, he risks not only significant financial losses, but gives his critics yet another chance to say that “the Mooch” is out of moves.

“I'm a very ambitious person,” he says. “As a Capricorn, I’m supposed to do everything right. I’m supposed to hit the f---ing mark. But when you get your ass kicked — like I did at the White House — if you're not cosmically aware, it can pull you into a tailspin.”

Despite it all, Scaramucci, who would have loved to become an actor had he not gone into finance, possesses a thick-skinned confidence born from decades of being underestimated. He says he knows there are people in his industry who look at him and think he’s a “greasy, oily, fast-talking, can’t-be-trusted, jerk-off salesman.”

He doesn’t really care. Smiling, he rattles off his accomplishments: eight books, two podcasts, Harvard Law School, Goldman Sachs, the creation of multibillion-dollar investment firm SkyBridge.

It’s a brag of the first degree, but for Scaramucci, the point isn’t just to list his accolades. It’s to remind everyone that, to him, the past is just a stepping stone to whatever comes next.

All eyes were on Scaramucci as he delivered his first press conference on July 21, 2017, as Donald Trump’s White House communications director. After grappling with some initial microphone issues, he took questions from reporters with a candor rarely seen in Washington. Scaramucci struck a humorous tone, joking about Trump’s golf game, quipping about needing “a lot of hair and make-up,” and famously ending the conference by blowing a kiss to the press.

It was his first — and, unbeknownst to him, his last. Scaramucci was an unconventional choice for the role, coming from Wall Street with no prior experience in political communications.

The next few days were a whirlwind. Scaramucci deleted old tweets critical of Trump, explaining that his views had “evolved.” He appeared on media outlets to defend Trump’s agenda and vowed to crack down on White House leaks, hinting at internal divisions.

Then came July 27, 2017. In a bid to uncover the source of leaks, Scaramucci called New Yorker reporter Ryan Lizza to probe his sources. Believing the conversation was off the record, he unleashed an expletive-filled tirade, calling then-White House chief of staff Reince Priebus “a f---ing paranoid schizophrenic, a paranoiac,” and saying “I’m not Steve Bannon, I’m not trying to suck my own c---.”

The interview went viral, and four days later, Scaramucci was fired. His 11-day tenure as communications director became a national punchline.

The fallout was swift and merciless. Late-night comedians had a field day. Stephen Colbert quipped, "Anthony Scaramucci, we hardly knewcci.” Saturday Night Live called him “human cocaine.” Trevor Noah joked that Scaramucci was fired so quickly that he didn’t even have time to finish getting his 'Scaramucci' tattoo.

Meanwhile, his personal life was unraveling. His wife of three years, Deidre, had filed for divorce, and he missed the birth of his son amidst the chaos. Adding insult to injury, Harvard Law School — his alma mater — mistakenly listed him as deceased in its alumni directory, sparking rumors of his death.

Reflecting on that period, Scaramucci admits he was out of his element and calls it a “cataclysmic failure” on his part. “When I walked out of the White House, I felt a sense of relief,” he says.

The final blow came when Trump tweeted about Deidre, claiming Scaramucci told him she was “driving him crazy” — a personal attack that left Scaramucci livid. That tweet severed their relationship for good, turning Scaramucci from a loyal ally into one of Trump’s most vocal critics.

Upon returning to New York, Scaramucci was determined to pick up the pieces. Before he and Diedre were set to finalize their divorce in September 2017, he sent her a text that read, “Before we finalize this, we should probably talk one more time.” They met for coffee, where she asked him, “What the f--- is wrong with you,” holding him accountable for the past six months. That conversation marked a turning point, and they decided to try to save their marriage. At her insistence, Scaramucci began working with a life coach to improve their communication and rebuild their partnership. Through the process, Deidre says, her husband came to understand the dynamics of being part of a team: “You can’t just live your life as a one-man band, you know?”

It was a brutal, humbling time. But for better or worse, Scaramucci thrives when the stakes are highest, finding purpose in the fight to claw his way back.

Scaramucci knows how to fight — he’s been doing it his entire life. Growing up in an Italian neighborhood on Long Island, N.Y., he was the middle of three children in a blue-collar family. His father worked as a crane operator, and his mother was a homemaker and cosmetologist.

In high school, Scaramucci was a standout: the football quarterback, class president, and owner of a 1979 maroon Camaro Berlinetta. “You just always knew Anthony was going to be a successful guy,” says Paul Montoya, a childhood friend since age 7.

Those closest to him credit his mother, Marie, for nurturing his unshakable confidence. “He was a very, very happy child who never really got in trouble,” she says. Neighborhood kids jokingly nicknamed him “Moses,” a nod to his seemingly golden reputation.

Yet behind the charm and charisma was a more complicated home life. His father’s tough, aggressive nature left its mark. “He was abusive,” Scaramucci says bluntly. “My brother became a drug addict and an alcoholic, and I became a workaholic.” He rarely speaks about this chapter of his life, except to mention his support for former MLB executive Joe Torre’s Safe At Home Foundation, which helps children affected by domestic violence.

When he wasn’t at school, Scaramucci was working odd jobs — delivering newspapers, shoveling snow, and hauling motorcycles with his uncle. Financial security was a constant undercurrent in his household. “I knew as a kid I needed financial stability. I needed financial independence,” he says.

Scaramucci’s ambition propelled him to Tufts University, where he earned a degree in economics in 1986 and graduated summa cum laude. He and his brother became the first in their family to attend college. On campus, he stood out, often for his Long Island style: leather motorcycle jackets, boots, and gold chains. His grandmother often told him, “What other people think about you is none of your business,” and this advice carried him through his college years.

Sol Gittleman, one of Scaramucci’s old professors at Tufts, told me that an early concept Scaramucci got hooked on in college was the idea of “schadenfreude,” the pleasure derived by someone from another person's misfortune. “Anthony fell in love with the idea, because he saw it in human beings a lot,” Gittleman says. To this day, Scaramucci emails Gittleman examples of the concept. “I might not hear from him for three or four months, and then all of a sudden, I get a blistering of emails about schadenfreude because he wanted to let me know that he was still looking for examples of [it].”

After Tufts, Scaramucci attended Harvard Law, where he once again felt like an outsider and quickly realized he didn’t want to practice law. After graduating, he failed the bar exam twice before pivoting to business. He joined Goldman Sachs in 1989 but was fired within a year. He was rehired in the equities division shortly thereafter, though his mentor, famed investor Mario Gabelli, encouraged him to aim higher. “You’re stupid,” Gabelli reportedly told him. “You’re not going to be a partner at Goldman Sachs. Go start your own business.”

Gabelli doesn’t recall the exact details of that early conversation, but he distinctly remembers advising Scaramucci years later when he was debating whether to sell his first business, Oscar Capital Management. “Anthony, when they're passing out cupcakes, if you don't take them, you're not going to get them again. Do it. Sell your firm,” Gabelli told him at the time. Scaramucci followed the advice, selling Oscar Capital to Neuberger Berman in 2001, which was subsequently acquired by Lehman Brothers.

In 2005, he founded SkyBridge Capital as a fund-of-funds, designed to invest the wealth of high-net-worth individuals into hedge funds and private investment vehicles. He positioned the firm as a way for America’s dentists and doctors—who might not have the means to invest directly in hedge funds—to still gain access to top-tier hedge fund managers through SkyBridge.

By 2008, the firm was struggling amid the financial crisis. That’s when Scaramucci made a bold bet: launching the SkyBridge Alternatives (SALT) Conference, a high-profile gathering of top hedge fund managers, Wall Street power players, and global investors. More than just an event, SALT became a financial lifeline—bringing in much-needed revenue through ticket sales and lucrative sponsorships while redefining SkyBridge’s trajectory.

At a time when Wall Street was reeling from historic losses and President Barack Obama was warning against extravagant displays of wealth, hosting a glitzy finance conference was a risky move. But Scaramucci saw an opening—positioning himself and SkyBridge at the center of the industry's recovery. As former Goldman Sachs colleague Bob Castrignano put it: “I think there are some people who underestimate Anthony at their peril.”

For the next eight years, Scaramucci thrived as a Wall Street insider, though his growing public profile came with new challenges. His name began appearing in the press, which took some getting used to. When financial commentator Felix Salmon, one of his early critics, described him as vain and a self-promoter, Scaramucci took it personally and even tried to get Salmon fired. “I was so hurt because I had not really been attacked ever in the press before,” he says.

Salmon, however, believes that Scaramucci’s success with SALT revealed his true strength: showmanship. “No one's ever taken him seriously as a financier, but they've taken him seriously as a convener and a friend to all of the financiers,” Salmon says. “He’s the guy who gets all of the big names to turn up, so that has historically been his role in finance.”

Public criticism became a recurring theme in Scaramucci’s career, but it wasn’t until a chance encounter with Donald Trump that he learned how to embrace it. The two had become acquainted through their social circles, and over lunch in New York in 2011, Scaramucci vented his frustration about being skewered in the media. As he remembers it, Trump told him: “You just got your cherry broken by a journalist? They’ve been writing all kinds of mean shit about me for the last 40 years. Shut the f--- up, and put your big boy pants on.” Trump could not be reached for comment.

Scaramucci says it was one of the most valuable lessons he learned from his former boss — advice that stuck with him during his humiliating post-White House period. During that time, Scaramucci — who has five children, including three from his first marriage — visited his oldest son A.J. in Los Angeles. The two went on a walk, and A.J. remembers asking him, “Are you good? This is a lot even for you,” to which Scaramucci responded with, “Give me a little bit of time, and watch what I do with this.”

A.J. wasn’t surprised. “I've seen my dad resurrect himself or rise from the dead so many times. We like to joke that he’s a thermonuclear cockroach — you can drop an atomic bomb on his head, try to blow him up, and he doesn’t give a f---,” he says.

When I ask Scaramucci how it felt to watch the public revel in his downfall, a grin spreads across his face. “You know what the word ‘schadenfreude’ means?” he asks. “‘I get pleasure from your pain.’ Now, why would somebody cheer for your demise?”

Does he think it’s envy?

“Isn’t that the reason?” he replies.

SkyBridge faced another turbulent stretch while Scaramucci was in Washington. Before joining Trump’s administration, Scaramucci had sold SkyBridge Capital to the Chinese conglomerate HNA Group. However, after regulatory delays and scrutiny from the Committee on Foreign Investment in the United States (CFIUS), the deal was terminated in 2018. Scaramucci returned as co-managing partner, focused on rebuilding the firm from the ground up.

Reinvention was both essential and urgent. Scaramucci and his team set their sights on a bold new frontier: digital assets.

In October 2020, SkyBridge Capital made its first Bitcoin purchase when the cryptocurrency was trading at just $13,000 per coin. By 2022, the transformation was undeniable — more than half of the programming at Scaramucci’s SALT Conference focused on digital assets. At that year’s SALT in New York, Scaramucci made headlines with a blockbuster announcement: Sam Bankman-Fried’s FTX Ventures would acquire a 30% stake in SkyBridge for $45 million. Most of the funds would go toward buying $40 million in digital assets, with the rest earmarked for new initiatives. "Sam is a visionary who has built incredible businesses that are synergistic with the future of SkyBridge," Scaramucci said at the time.

Bankman-Fried wasn’t just a visionary in Scaramucci’s eyes. Dubbed “the next Warren Buffett” by FORTUNE, featured on the cover of Forbes, and named one of TIME’s Most Influential People of 2022, the so-called crypto wunderkind had the world’s attention. Partnering with SkyBridge only bolstered his credibility, especially in traditional finance circles. Soon after, Bankman-Fried leveraged Scaramucci’s Middle Eastern connections to court investors in Saudi Arabia and the United Arab Emirates. “We delivered on everything he could have dreamed of,” says SALT CEO John Darsie, who helped introduce Bankman-Fried to deep-pocketed investors in the Middle East.

But behind the scenes, cracks were forming. Bankman-Fried reportedly told a group of regulators in Dubai that he wanted the UAE government to expel Binance, FTX’s competitor, to cement his dominance in the region. Not long after, Binance’s CEO Changpeng Zhao, got wind of Bankman-Fried’s hostility and retaliated. He announced Binance would liquidate its holdings of the FTX-related FTT token, triggering a run on FTX that culminated in its collapse. By the end of 2022, FTX was bankrupt, its operations exposed as a massive fraud. Bankman-Fried was later convicted on multiple charges and sentenced to 25 years in prison.

The fallout shook the crypto world — and those associated with Scaramucci. “It was a very dark time for me, professionally and personally,” Darsie says. “I wanted to go into hiding.” Scaramucci, however, refused to hide. He went on CNBC, addressed the scandal directly, and even returned to the Middle East to repair relationships.

But the damage was done. Bitcoin had plummeted to $16,000, SkyBridge’s flagship fund was down 39%, and Scaramucci was again mocked in the press. The New York Post ran a cartoon of him sinking in a Bitcoin-filled dinghy labeled the “S.S. Mooch,” while Bloomberg Businessweek wrote what he calls his “financial obituary.” Instead of shrinking from the criticism, Scaramucci leaned in. He framed the cartoon, printed it on T-shirts, and turned it into a bobblehead on his desk. His failures became trophies, a reminder that even the harshest ridicule can be repurposed into a badge of resilience.

Undeterred by public criticism, Scaramucci doubled down on Bitcoin. By the end of 2024, more than 57% of SkyBridge’s $2.7 billion in hedge fund assets were in cryptocurrencies, a stake worth approximately $1.4 billion. Scaramucci says that Bitcoin comprises half of the firm’s 'nine-figure' balance sheet. He himself has over 60% of his personal net worth in Bitcoin. “We fundamentally believe this is a technological shift in finance,” he says. “This asset should be worth $20 trillion.”

For now, Scaramucci’s bet appears to be paying off. In December 2024, Bitcoin surged to an all-time high of $100,000 per coin, driving a banner year for SkyBridge. The firm’s $1.7 billion flagship fund posted a 43% return — its strongest performance since the firm’s inception. It significantly outpaced the HFRI Fund of Funds Composite Index, a key benchmark for the hedge fund industry, which returned 9.8% over the same period.

SkyBridge’s performance in 2024 ranked among the top 10 best-performing funds of the year, surpassing even some of Wall Street’s most iconic hedge funds, including Tiger Global, Citadel, Coatue, and Pershing Square. “People count him out over and over,” says Barbara Fedida, chief operating officer of SALT Media. “But Anthony loves the comeback more than he loves the climb.”

In an ironic twist, Trump’s return to the White House may also work in Scaramucci’s favor. The president and his advisers see cryptocurrency as fundamental to their economic policies, recently announcing plans to evaluate the creation of a national digital asset stockpile—a reserve of cryptocurrencies like Bitcoin, designed to be deployed during economic crises or significant supply disruptions.

While Scaramucci admits that Trump may be good for his wallet, he calls him an “oligarch” who is a danger to society. “Sure, I'll be richer. Is that good for my country?” he says. “What I know is that I don't want to live in a McMansion with a barbed-wire security perimeter while my fellow neighbors are suffering.”

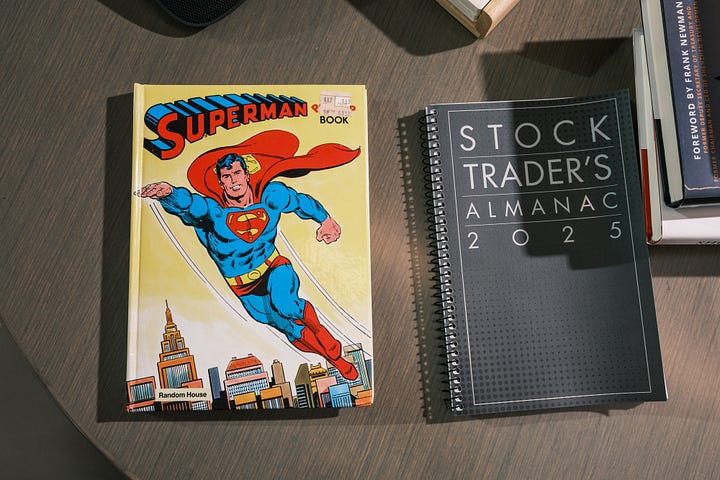

Scaramucci insists he doesn’t need vindication. Yet on his bookshelf, alongside the sinking S.S. Mooch bobblehead, sits a figurine of himself in a suit with a Bitcoin pin and an orange superhero cape. The inscription at the base reads: “We won! Fuck off.”

To say Scaramucci has an obsession with superheroes would be an understatement. Step into his midtown office lobby, and you’re greeted by a towering 6’5” Superman sculpture standing next to a bold, large-scale Superman painting. Inside Scaramucci’s glass-walled corner office, a framed 1942 Superman comic hangs prominently, while tiny Superman figurines line his bookshelves.

The story of Superman is well known: Born Kal-El on the doomed planet Krypton, he was sent to Earth as a baby and raised by the kindhearted Kent family in Smallville, Kansas, where he discovered his extraordinary powers. As an adult, he became Clark Kent, a mild-mannered reporter by day who used his abilities as Superman to protect humanity, fight for justice, and embody hope. “He’s an immigrant, he’s a loner, he’s an outsider,” Scaramucci explains.

To him, Superman represents an aspirational ideal — a version of ourselves we can never fully achieve. “Superman is who we want to be. Batman is who we are,” Scaramucci tells me. “We’re dark, we’re human. We can get injured. If we’re fighting as a vigilante, some things will go right, some things will go wrong.”

In some ways, Superman’s story parallels Scaramucci’s own. Just as Clark Kent has the alter ego of Superman, Scaramucci has “the Mooch,” a nickname bestowed upon him by an elementary school gym coach who couldn’t pronounce his Italian last name. While playful, “the Mooch” is also a persona — an amplified, larger-than-life version of Scaramucci himself, dialed up when the moment calls for it.

One such moment unfolds during a speaking engagement at a midtown accounting firm. A man in a suit whispers, “There he is” as Scaramucci walks by on the way to a tucked-away conference room before the main event. He’s an expert networker (and therefore knows never to say, ‘Nice to meet you,’ just in case he’s met the person before. The correct greeting is always, ‘Nice to see you.’)

During the fireside chat, The Mooch is in full force, and the interviewer’s four-minute introduction is a setup Scaramucci can’t resist. He jumps in with self-deprecating quips — about his White House firing, lasting “945,000 seconds” as communications director, the infamous S.S. Mooch cartoon, and even his children: “I’ve got five ‘official’ kids… don’t give me an extra one.” He’s playful, confident, and utterly at ease, even as he delves into the most painful chapters of his life.

Scaramucci recounts his fight to save his marriage during his White House stint, how Deidre filed for divorce, how they still loved each other, and how he regrettably missed the birth of his son while attending a Boy Scouts convention with Trump. “Can you believe this?” he asks the crowd. Three women in the front row shake their heads empathetically. “It was a terrible, terrible year for me,” he says.

Scaramucci relishes sharing these stories because he understands a simple truth about the human condition: we connect with each other far more deeply over our failures than our successes. He’s been there, done that, failed spectacularly—and lived to tell the tale.

After the talk, Scaramucci is mobbed. He takes selfies, shakes hands, and listens to attendees share their own struggles with adversity. On the way out, a woman in the elevator marvels, “The personal anecdotes, I mean, they were amazing.”

“I’d rather you hear the f---ing truth,” he tells her. “Everybody is going through something. Nobody gets out of this world without going through something.” She asks to connect on LinkedIn, and Scaramucci promises to accept her request.

The day isn’t over yet. After an 11-hour marathon, Scaramucci heads to a client dinner at Rao’s, an iconic Italian restaurant with only 10 tables, each “owned” by regulars who pass them down like family heirlooms.

As we part ways, I ask him about his legacy. Like Superman, every hero’s journey culminates in a crucible — a final test that defines their transformation and cements their place in history. For Scaramucci, that test is unfolding now.

Will his bet on Bitcoin pay off? Will he be vindicated, or will he face public mockery once again?

But, Scaramucci reminds me — a Virgo whose cosmic challenge is learning to “see the gray” — that I, like the rest of America, often can’t see nuance. It’s not about winning or losing, he says. It’s not about legacy. Or relevance. Or vindication.

He’s not focused on the next 20 years. He’s focused on tomorrow — staying alive to fight another day. “I love the fight,” he says. “I like it because it's a game. A game — fun. I want to be in the game.”

--

Written by Polina Pompliano | Edited by Lauren Covello Jacobs & Laura Entis | Photos & video by Stephen Yang

… For more longform profiles, make sure to sign up for The Profile here:

Check out more original profiles here:

New York's Most Powerful Woman Is Retiring. But Don’t Call This Her Last Act.

Kathryn Wylde is in the back seat of a car, working the phone as she arranges a meeting between New York City’s most powerful figures and its incoming mayor, Zohran Mamdani.

Saquon Barkley Is Playing for Equity

Saquon Barkley calls me, but he’s distracted. In the background, two little voices shout “Bye, friends!” as Barkley wrangles his kids, Jada, 7, and Saquon Jr., 3, into the car. He apologizes, then explains they’re headed to an Old Spice photo shoot tied to his latest endorsement — a Saquon-branded shampoo and conditioner called “Saquon Soar.”

Ryan Serhant Won’t Stop Until He’s No. 1

In the greenroom at the TODAY show, Ryan Serhant, dressed in a tailored sage suit and sporting his signature gray hair, flips through notes as producers buzz around him.